The FR Y-14 is a comprehensive capital assessment and stress testing report used by the Federal Reserve Board to monitor and assess large banking organizations' financial health and stability. This reporting requirement is part of the Board's broader supervisory and regulatory framework, particularly for institutions considered systemically crucial due to their size, complexity, and interconnectedness in the global financial system.

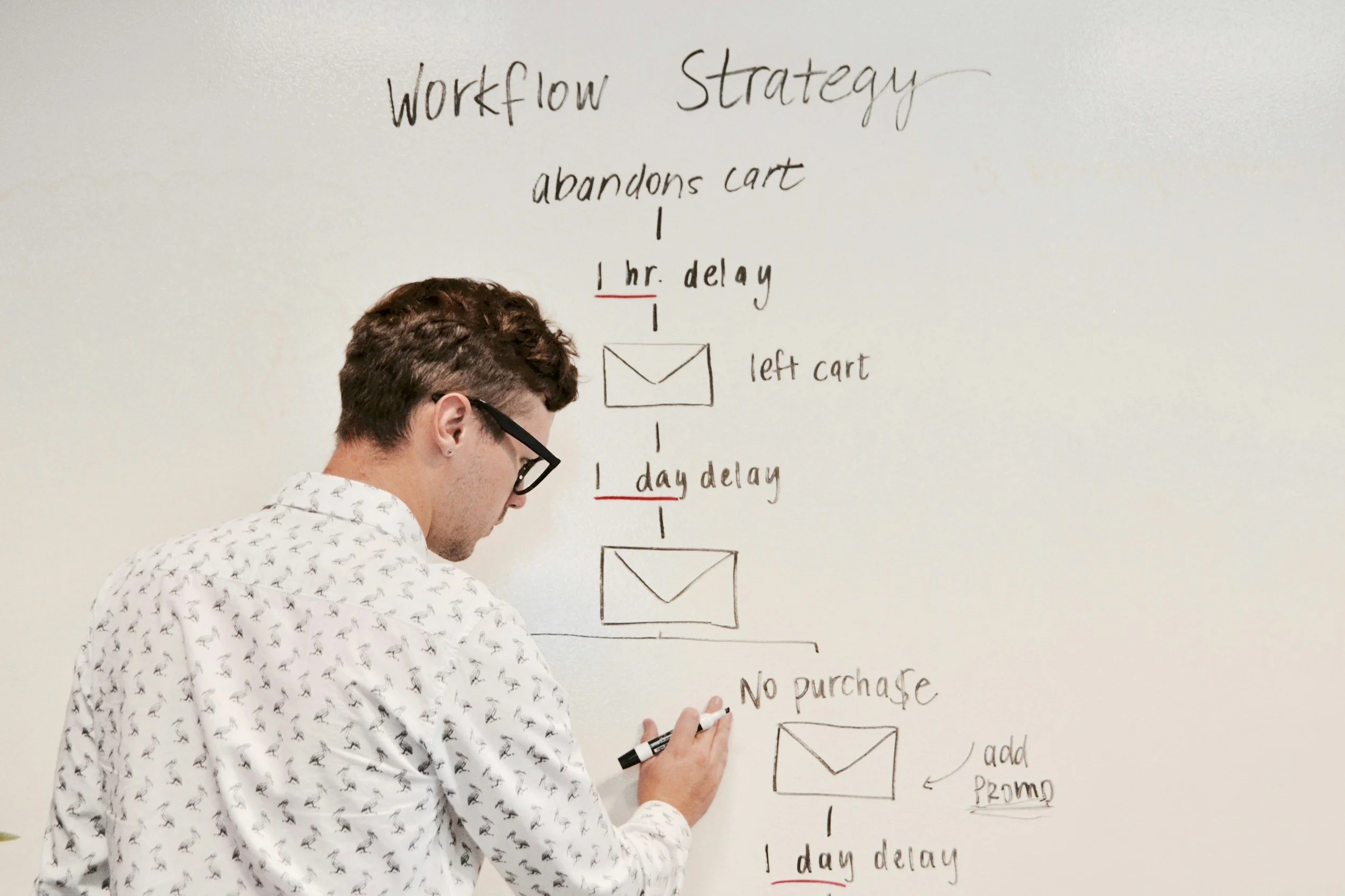

The main goal was to capture every process from beginning to end.

Some of the benefits of working on the project:

Improved process efficiency and end-to-end process management streamline workflows by reducing handoffs and bottlenecks.

Enhanced visibility and control gaps in the process.

Better quality and consistency in the process, lead to consistent outcomes.

Possible finding duplicating processes around the organization causes cost reduction.

This holistic view makes it easier to identify and mitigate risks across the process.

Continuous monitoring and analysis of end-to-end processes generate valuable data, providing insights into performance, and operational bottlenecks.

It created a cross-functional collaboration involving multiple departments and teams.